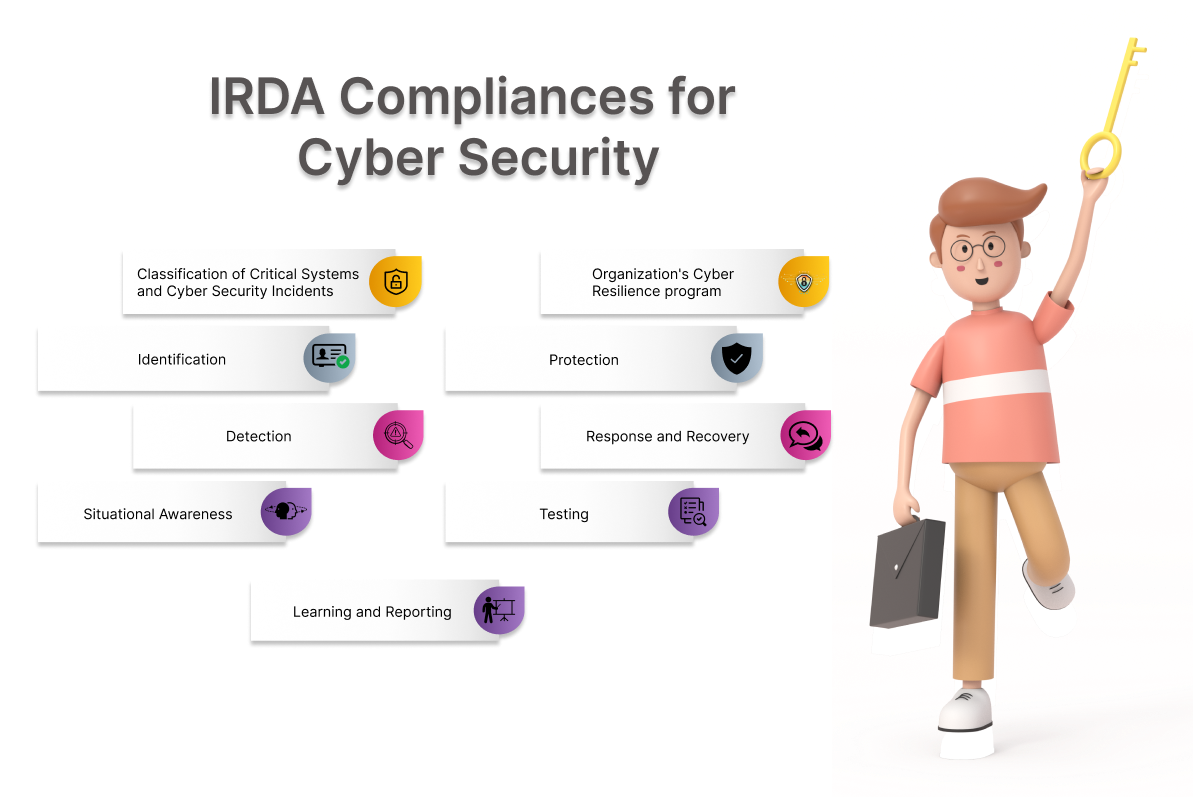

IRDA Compliance for Information and Cyber Security

IRDA Compliance

To raise awareness and provide guidelines to organizations for addressing cyber security and related risks to the insurance sector and the mitigation of such risks. The Insurance Regulatory and Development Authority of India (IRDAI) has mandated insurance companies to implement measures to safeguard their sensitive information and data from cyber threats. The key compliance requirements include having a robust Cyber Security Policy, conducting periodic risk assessments, having an incident response plan, protecting data from unauthorized access, managing third-party vendors, conducting regular training and awareness programs, and reporting any cyber incidents to the IRDAI within a specified timeframe. By complying with these guidelines, insurance companies can ensure that they have adequate information and cyber security measures in place to protect their critical assets and data.

Why IRDA Compliance Required?

IRDA compliance is required for cyber security because insurance companies deal with sensitive information and data of their customers, such as personal details, financial information, and health records. The loss or compromise of such information due to cyber-attacks can cause financial losses and reputational damage to the insurance company. Moreover, cyber attacks on insurance companies can also affect the wider financial system, making it imperative for the regulator to ensure that insurance companies have adequate information and cyber security measures in place to safeguard their critical assets and data. The IRDA compliance guidelines provide a framework for insurance companies to implement these measures and minimize the risk of cyber threats.

Requirements

Information Protection

User Authentication and Authorization

Thorough Examination

Internal Monitoring Controls

Assessment of Controls

External Review

Review of Accounting Practices

Responsibility with Respect to Fraud

Vision and Objective

To ensure that a Board approved Information and Cyber Security policy is in place with all insurers.

To ensure that necessary implementation procedures are laid down by insurers for Information and Cyber Security related issues.

To ensure that insurers are adequately prepared to mitigate Information and cyber security related risks.

To ensure that an in-built governance mechanism is in place for effective implementation of Information and cyber security frame work.

Achieve your Cyber Security Compliance

Approach

Business Understanding

Evaluating business process and environment to understand the in-scope elements

Scope Finalization

Finalize the scope elements and prepare the requirement documentation

Readiness Assessment

Identify the potential challenges that might arise during requirement implementation

Risk Assessment

Identifying and analysing the risks in the information security posture.

Data Flow Assessment

Conducting thorough systems analysis to evaluate data flow and possible leakages

Documentation Support

Assist you with list of policy and procedure to help you in validation or evidence collection

Remediation Support

Support you by recommending solutions to compliance challenges

Awareness Training

Conduct awareness sessions for your Team and personnel involved in the scope

Scans And Testing

Identify critical vulnerabilities in your system with a robust testing approach

Evidence Review

Review of the evidence collected to assess their maturity, in line with the compliance

Final Assessment and Attestation

Post successful assessment, we get you attested for compliance with our audit team

Continuous Compliance Support

Support you in maintaining compliance by providing guidelines